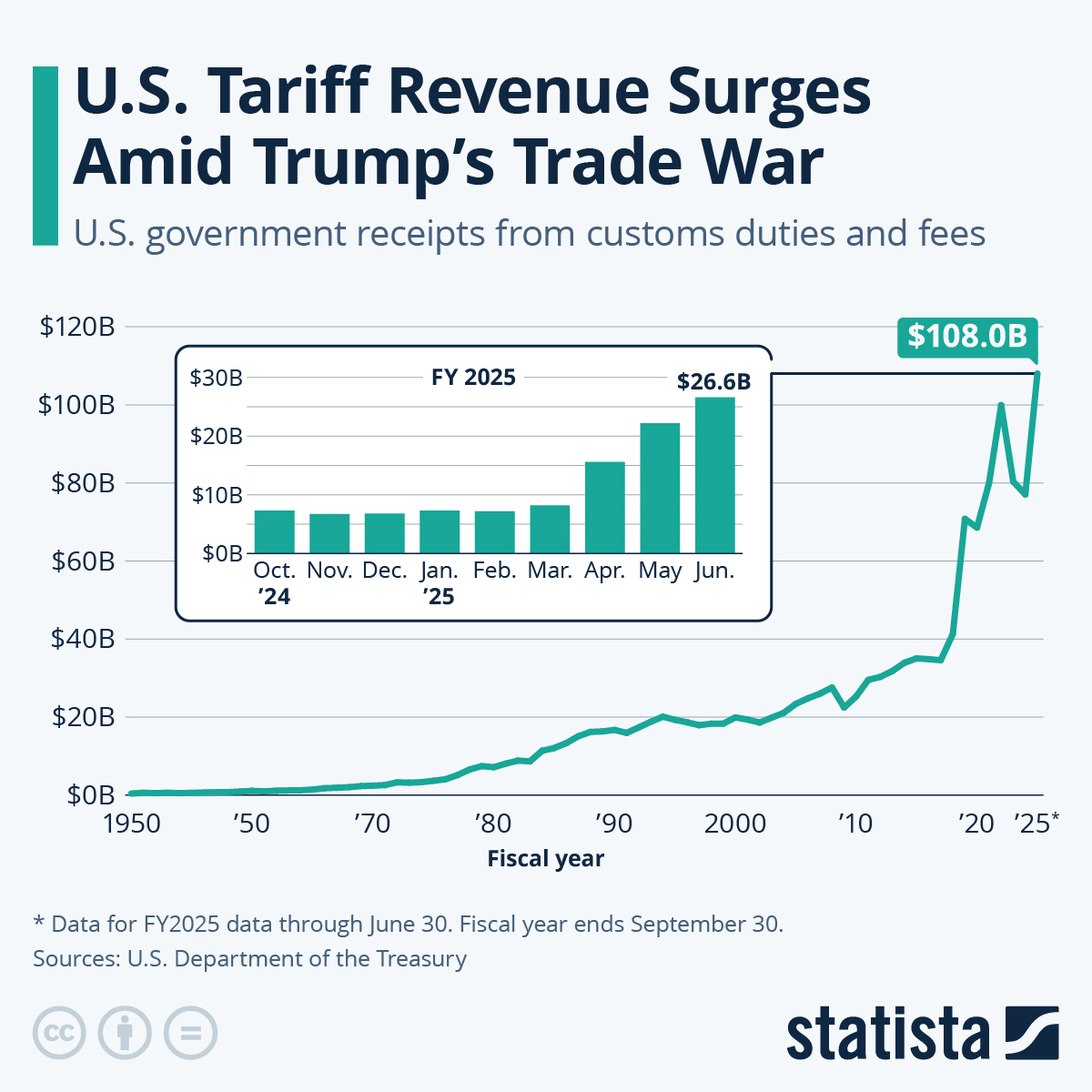

In a historic milestone, former President Donald J. Trump’s trade policies have amassed a staggering $150 billion in tariff revenue from foreign countries since implementation, with July alone bringing in $28 billion—the highest single-month collection in U.S. history.

While supporters hail this as a sign of a strong America-first economic strategy, economists remain divided on the broader implications.

Short-Term Economic Boost

[Infographic: Tariff Revenue Growth Chart from 2018 to 2025, Highlighting July’s $28 Billion Hit]

Tariffs, designed to pressure foreign nations—particularly China—into fairer trade practices, have generated unprecedented revenue streams for the federal government. This windfall has:

Funded key agricultural subsidies, helping offset retaliatory tariffs that hit U.S. farmers.

Protected domestic industries, particularly steel and aluminum manufacturing, from cheaper foreign imports.

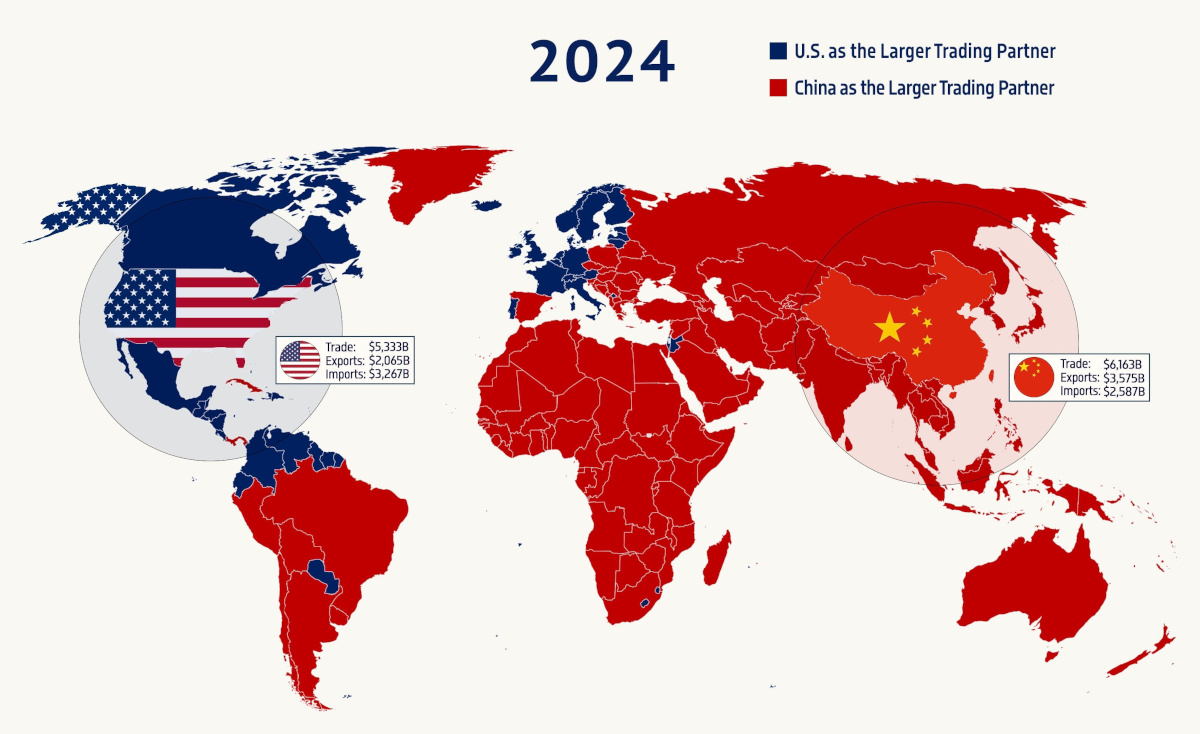

Strengthened leverage in trade negotiations, forcing partners to revisit longstanding agreements that many economists argued disadvantaged American businesses.

Trump’s supporters argue that this $150 billion is tangible proof that foreign countries—not American taxpayers—are footing the bill for his “America First” trade agenda.

Economic Strain and Consumer Impact

Image: US consumers shop in supermarkets as prices rise

However, this success comes with caveats. While tariffs boost government revenue, import costs often trickle down to consumers, leading to:

Higher prices on everyday goods, including electronics, clothing, and automobiles.

Inflationary pressure, particularly noticeable during 2022 and early 2023.

Supply chain disruptions, as foreign suppliers adjust to higher U.S. trade barriers.

Small businesses relying on imported components have been among the hardest hit, with some facing narrowed profit margins or having to cut jobs.

Future Outlook: Sustainable Strategy or Looming Risks?

Looking ahead, economists are split:

Optimistic View: Continued tariffs could incentivize reshoring of manufacturing, strengthening U.S. self-sufficiency and reducing reliance on volatile global supply chains.

Skeptical View: Prolonged tariffs risk trade wars, dampening international cooperation and potentially triggering long-term inflation that undermines the initial gains.

There are also concerns that foreign nations might develop alternative trade partnerships, diminishing U.S. influence over time.

Conclusion

Trump’s tariff strategy has undeniably reshaped the U.S. trade landscape, delivering a record-breaking revenue surge and redefining leverage in global commerce.

But as the nation looks to the future, the real question remains: Will these tariffs lay the foundation for a stronger, more independent American economy—or spark prolonged economic friction that outpaces short-term gains?

News

‘South Park’ Sparks Controversy with Savage Satire of Charlie Kirk—Turning Point USA Founder Claps Back in Heated Fox News Digital Interview, Fans Divided as Social Media Explodes Over Animated Takedown|KF

‘We as conservatives need to be able to take a joke,’ the Turning Point USA founder told Fox News Digital…

Love Island USA Drama Explodes: Kenny Rodriguez Finally Breaks Silence on Painful Split from JaNa Craig After Nearly a Year Together—Fans Stunned as Emotional Confession Sparks Rumors About What Really Ended Their Romance|KF

JaNa Craig and Kenny Rodriguez. Trae Patton/PEACOCK Love Island USA’s Kenny Rodriguez has spoken out after his split from JaNa Craig. “The past few…

Connie Francis, Trailblazing Pop Legend and First Female Solo Artist to Top Billboard Hot 100, Dies at 87—The Icon Behind ‘Who’s Sorry Now?’ Leaves Behind a Timeless Legacy|KF

Connie Francis.Credit : Archive Photos/Getty “Pretty Little Baby” singer Connie Francis has died at age 87, her close friend, Ron…

Huda and Chris Finally Reveal the Truth Behind Their Breakup and the Real Story of That Viral ‘Carry Me’ Moment Love Island Fans Didn’t See on Screen|KF

Ben Symons/Peacock) Love Island USA’s Chris Seeley and Huda Mustafa know viewers have thoughts on their chaotic breakup. “Y’all were laughing about it. I…

Hope Turns to Grief as Katherine Ferruzzo’s Body Is Found 7 Days After Texas Flood—Camp Mystic Counselor Remembered as a Hero Who Tried to Protect the Kids|KF

Ferruzzo’s family released a statement confirming that the 19-year-old’s remains were found on Friday, July 11 Courtesy of…

Megan Thee Stallion deletes TikTok showing her unwrapping gifts on Klay Thompson’s lap|KF

Megan Thee Stallion added fuel to the fire that she is dating Dallas Mavericks star Klay Thompson after deleting a…

End of content

No more pages to load